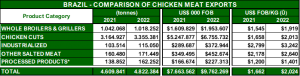

The year 2022 was favorable to Brazilian exports of chicken meat and its products, reaching a total of 4,822,384 tons, an increase of 4.61% compared to 2021. The most relevant was the 27.39% increase in value of these exports (US$ 9.762 billion) thanks to better average prices obtained, which evolved from US$ 1,662 ptm in 2021 to US$ 2,024 ptm in the year just ended.

The breakdown of the composition of Brazilian chicken exports can be found in Table I.

Table I  *It includes stuffed chicken products such as sausage, sausage, ham, mortadella, etc.

*It includes stuffed chicken products such as sausage, sausage, ham, mortadella, etc.

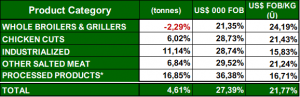

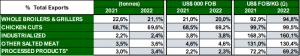

In table II we can observe the percentage evolution of each of the categories. The greatest evolution in average prices was experienced by the whole chicken, which was the only product category to have suffered a drop in volume, translating the progressive reduction in imports from Saudi Arabia. These were partially offset by the position of the United Arab Emirates that now holds as the second largest recipient in volume of Brazilian chicken and the third most important market in terms of value.

Table II – Evolution Δ % by Product Category from 2022 to 2021

I usually start the training I’ve given corporate executives with a presentation entitled “Things Change” which concludes with the one immutable and timeless truth: “that things will keep changing and ever faster.” And the whole chicken that replaced the live chicken is today replaced by chicken parts and these will be themselves in the presentations that allow the consumer to prepare them if they know how to turn on an oven. In brief, the whole chicken will continue to lose ground, even if helped by protectionist ills.

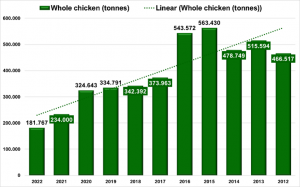

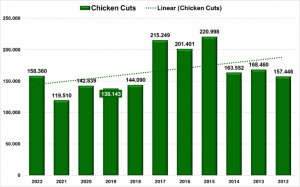

Table III shows the progressive advance of chicken cuts that has become by far the most important product category and that gains importance every year.

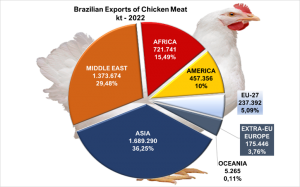

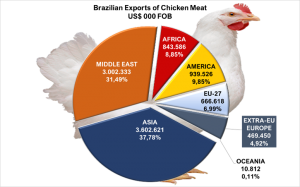

Graphs I and II show the destination of Brazilian exports by World Region, led both in volume and in value by Asia and followed by the Middle East. In statistics from international organizations, countries in the Middle East are classified as part of Asia, which would increase the importance of this region not only for chicken exports, but as the main destination for all Brazilian agribusiness exports.

Graphic I – Exports of Chicken Meat and Products Volume  Graphic II – Exports of Chicken Meat and Products Value

Graphic II – Exports of Chicken Meat and Products Value

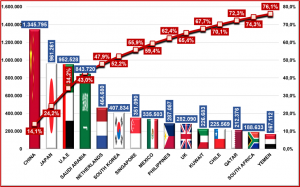

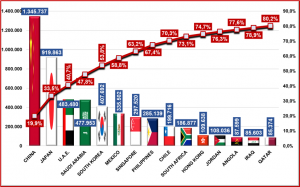

Of the 169 countries that imported chicken meat and its products, values range from almost nothing (US$ 10.00 – sample shipment surely) to US$ 1.35 billion (14.1% of the total exported value) purchased by the Planet China, followed by Japan’s $961 million, U.S.$952 million. and US$ 844 million by Saudi Arabia, which reduced purchases of whole chicken, but remains one of the largest importers of chicken meat and its products.

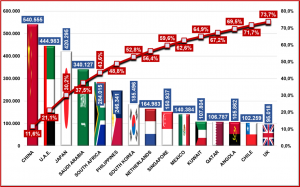

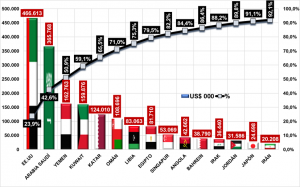

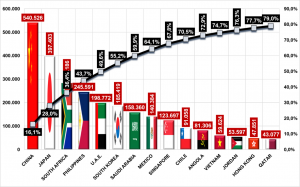

The Pareto graphs III and IV that follow list the fifteen largest importers in volume and value and I confess that I had to resist the temptation to publish the complete list of importing countries, following the advice of an editor of a magazine specialized in agribusiness: “synthesis represents more readers. It is un article Osler, not a dissertation.”

Graph III – Brazil – Volume of Exports of Chicken Meat and Products (t) -2022

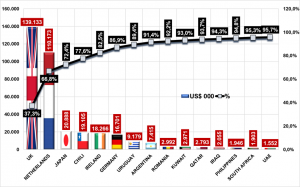

Graph IV – Brazil – Value of Exports of Chicken Meat and Products (US$ 000 FOB) -2022

Observe in these graphs that only two European countries are included among the fifteen largest importers of chicken meat and its products, namely the Netherlands (3.5% of volume and 4.9% of value) and the United Kingdom of Brexit (2 % of volume and 3.0% of value)

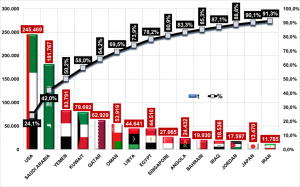

Even at the risk of being too much, I will list in Graphs V and VI the top fifteen importers of whole chicken, which, as shown in Table III above, represents 20% of our total chicken meat exports.

Graph V – Brazil – Volume of Exports of Whole Chicken, both broilers and grillers (tonnes) -2022

Graph VI – Brazil – Value of Exports of Whole Chicken, both broilers and grillers (US$ 000) -2022

It is interesting to observe the sharp decrease in Saudi imports of whole chicken (cf. Graph VII), also felt less sharply in chicken cuts, which explains the decline of that country to fourth place as a destination for Brazilian chicken.

Graph VII –Exports Whole chicken to Saudi Arabia (kt)  Graph VIII – Exports Chicken Cuts to Saudi Arabia (kt)

Graph VIII – Exports Chicken Cuts to Saudi Arabia (kt)

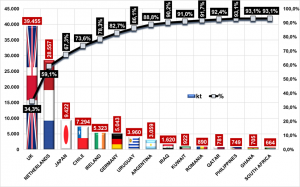

Chicken parts or cuts dominate consumption in most countries, and this translates into Brazilian sales abroad, representing just under 70% (cf. Table III) of total chicken meat exports. In Graph X we list the fifteen main importers of this category of products in tonnage. Note that of these fifteen, seven of them are in Asia, four in the Middle East, two in Latin America and two in Africa.

Graph IX– Pareto – Brazil – Volume of Exports of Chicken Parts or Cuts (t) -2022

As for the value of exports of chicken cuts/parts, the top fifteen importers account for 80.2% of total exports, six of them being in Asia, five in the Middle East, two in the Americas and one in Africa

Graph X– Pareto – Brazil – Value of Exports of Chicken Parts or Cuts (US$ 000) -2022

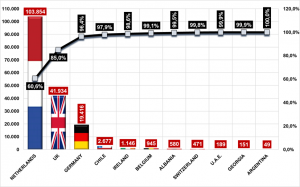

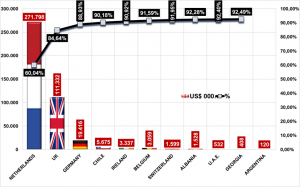

Note that in the product categories presented so far (whole chicken and parts) there are no European countries. These completely dominate the salted meat category, led by the Netherlands, which once again confirms its condition as a platform for European international trade. Together with the United Kingdom and Germany, these three countries account for 96.4% of the volume of salted chicken meat (cf. Graph XII) and 88.9% of the value exported in this category.

Graph XI – Pareto – Brazil – 11 Main Importers in Volume of Salted Chicken Meat (t) -2022

Graph XII – Pareto – Brazil – 11 Main Importers in Value of Salted Chicken Meat (US$ 000) -2022

Five European countries are among the main Brazilian customers for industrialized chicken meat products, three from South America, the same number from the Middle East, two from Africa and two from Asia. It is interesting to observe that Great Britain and the Netherlands are the destination for almost 60% of the volume and 66% of the value of Brazilian foreign sales of industrialized products.

Graph XIII- Brazil – Fifteen Main Importers of Industrialized Chicken Products – Volume (kt)

Graph XIV- Brazil – Fifteen Main Importers of Industrialized Chicken Products – Value (US$ 000)

In brief, 2022 was a good year for Brazilian chicken exports and the country consolidates its position as the second largest producer in the world and the first exporter of chicken meat. For the year 2023, forecasts from different international sources place the growth of Brazilian exports between a minimum of 2.7% and a generous maximum of 6%. I will endorse the Latin maxim of “virtus in medium est” (virtue is in the middle).

I have stated on several occasions that Brazil is a world agribusiness power located in a country that does not count internationally, and against which it is possible to exercise brazen protectionism with the guarantee that the country has no way of retaliating. And sweets in international politics are always reserved for those who don’t behave and who can throw stones, especially in their current atomic version.

However, in 2022 the country exported chicken meat to 169 countries and closing the doors of these markets would have severe effects on international prices and supply, since Brazil accounts for something over 30% of world exports of meat and chicken products.

This does not exempt this country from great concerns and care with the episodes of HPAI that are widespread in the world and have reached neighboring countries in South America, six of which border Brazil (Argentina, Bolivia, Colombia, Peru, Venezuela and Uruguay) .

Care is renewed, our association, ABPA (Associação Brasileira da Proteína Animal) mobilizes the sector and Brazilian poultry science to increase levels of prevention, care and biosafety. There are currently several conferences organized by different scientific entities on biosafety, on HPAI and advances in prevention and containment of episodes.

Even so, the risks are high that the disease will reach Brazil. The protectionists, especially the European Union that suffers from selective Alzheimer’s, will forget their collection of episodes and with horror will wave the warning flags claiming that Brazil is the root of all evils. We have already learned from their energetic matrix that the secular maxim of “do as I say, not as I do” remains eternally new.

However, many countries will not risk compromising their supply and will adopt the scientifically recommended safeguard measures but will maintain the flow of purchases from Brazilian regions and compartments not affected by the disease. We have reasons to be concerned, but if we have a merit in the agribusiness of this poor rich country, it is that we are resilient.

In January 2023, Brazilian chicken meat exports (considering all products, both in natura and processed) totaled 420.9 thousand tons, informs the Brazilian Association of Animal Protein (ABPA). The number is a record for the month and exceeds by 20.6% the total exported in the first month of 2022, with 349.1 thousand tons. The result in dollars of the month’s exports reached US$ 856.6 million, a figure 38.9% higher than that achieved in the same period of the year.

Even so, it is not with peace of mind that we face the forecasts for 2023, as the entire history of HPAI outbreaks shows that the spread of the disease to neighboring countries occurs inevitably.

We hope are wrong, but facts and data indicate that this statement is more a wish than reality.